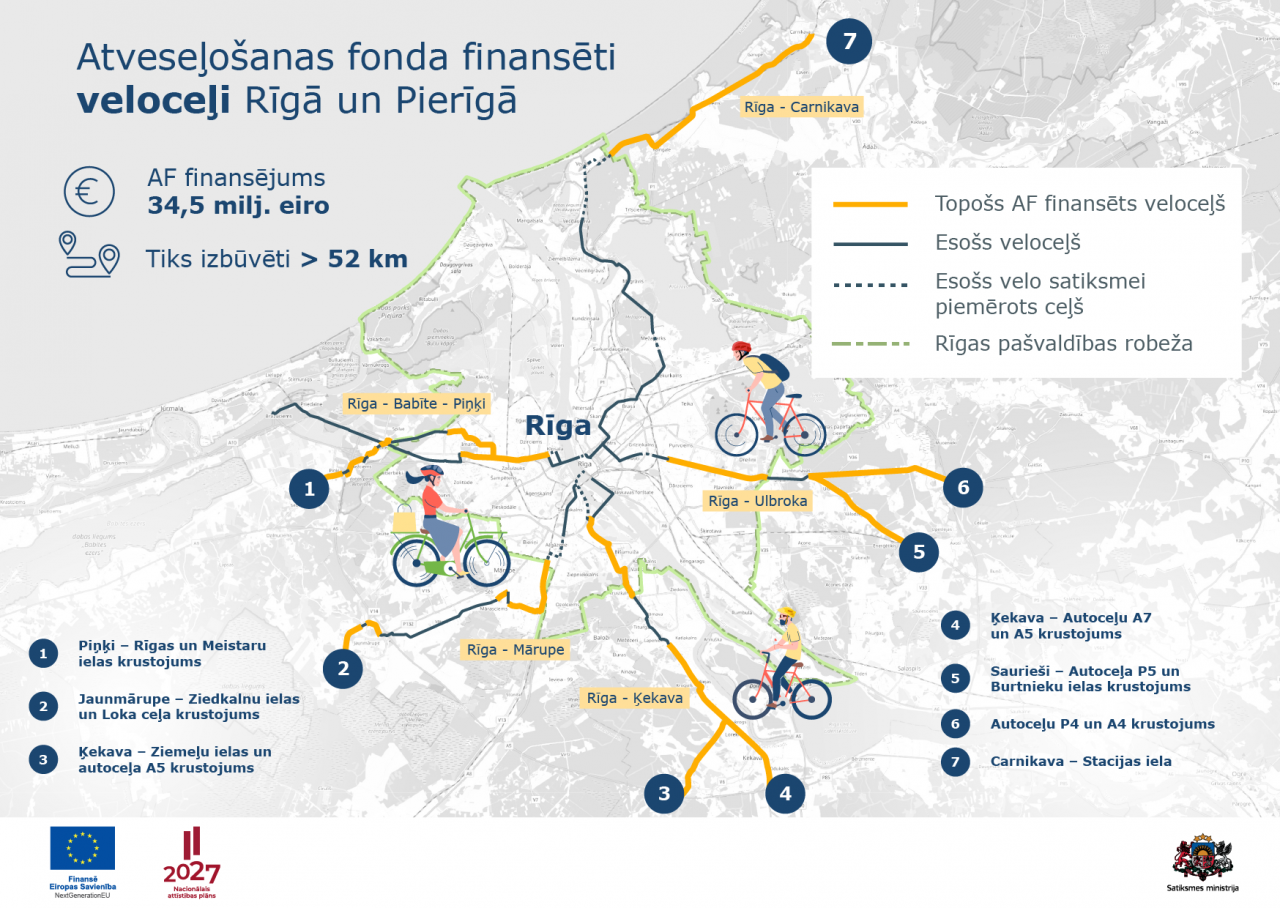

Latvia recently submitted to the European Commission (EC) a Recovery and Resilience Facility Plan costing 1.82 billion euros, which will be financed by the European Union (EU) through funding the EC will borrow on its behalf on the financial markets. In total, the EC plans to borrow 672.5 billion euros (in 2018 prices) to finance Member States' plans.

In this article, I will focus on the most important aspects of raising and repaying this funding and the relative sizes of these plans.

First of all, it should be noted that the mentioned amount must be divided into two parts. 360 billion euros from the EC borrowing will be further lent to Member States. These will be the countries that have chosen to create their Recovery and Resilience Facility Plans as large as possible, financing them not only from the non-refundable funding (grant) provided by the EU, but also from the loan provided by the EU to these Member States. In this case, the countries will repay the loan received gradually and will start to do so only after a certain period of time (tentatively, ten years is currently being discussed as the period of time). This loan repayment, in turn, will be used by the EC to repay its borrowing from the financial markets. Although the loan to the state is considered safe, there is a possibility that the state will not be able to cover its obligations within a certain period of time. In that case, the EC covers its obligations towards the financial markets at the expense of the EU budget and then recovers the funding from the respective Member State. Such a financing scheme is not new and is similar to what the EU has used until now, for example, when lending money to Latvia during the previous crisis.

The chosen solution for the second part - 312.5 billion euros - is completely different and innovative. In this case, as before, the EC will borrow money from the financial markets, but then it will be allocated to the Member States as a non-repayable funding (grant) for the implementation of the national Recovery and Resilience Facility Plans. This is an innovative solution in the EU, as for the first time the EU is borrowing money to finance EU budget spending.

In the case of Latvia, it is the already mentioned 1.82 billion euros. Therefore, it is a logical question - where will the EC get funding to repay its borrowing from the financial markets? Theoretically, there are two possibilities - one, that the loan is repaid by making another loan, or the loan is refinanced. Refinancing can be carried out indefinitely and the issue of repayment can therefore be pushed indefinitely into the future. Countries usually finance their borrowing in the financial markets according to the following scheme.

In this case, the EU has chosen another option - to settle its obligations towards the financial markets by 2058, which means that the funding paid out in grants to the Member States in the EU must be repaid to the financial markets from their own resources. From the lender's point of view, the EU's ability to repay the debt is a key issue. If a loan is issued to a Member State, it is considered a relatively safe investment, since Member States, even if there are difficulties in refinancing the debt, are also endowed with the right to collect additional resources from their companies and citizens. There are no such possibilities in the EU. In order to ensure the highest credit rating for EU bonds, a legal mechanism is needed to ensure the EU's ability to repay the debt in any case. This is done by increasing the ceiling of the EU's own resources.

The EU's annual budget is capped. Under the Council Decision of 14 December 2020 on the EU's own resources system, the annual budget must not exceed 1.4% of the Gross National Income (GNI) of all EU Member States in a given year. In fact, this decision means that the EU Member States together contribute funding to the EU budget each year in an amount that does not exceed this ceiling. The EC can count on it and undertake to make relevant payments from the EU budget. This has been the case in previous years as well.

What is new this time is that the Council Decision of 14 December 2020 increases the own resources ceiling above the 1.4% by 0.6% of GNI to allow the EC to assume the liabilities arising from borrowing on financial markets. From the lender's point of view, this means that regardless of how the EU chooses to obtain the resources for debt repayment, the EU Member States have undertaken to repay the debt if necessary by contributing an additional 0.6% of GNI to the EU budget. These obligations are joint and several.

Thus, in order to cover the consequences of the Covid-19 crisis, the EU Member States have agreed to issue a joint debt for which they take joint responsibility, in order to allocate financing for the prevention of the consequences of the crisis to all, but relatively more economically weaker and crisis-affected countries.

It should be noted that the decision of 14 December 2020 has not yet entered into force. It will enter into force when all EU countries have completed their national procedures for approval of the own resources decision. Until then, the previous own resources decision is in force, which does not foresee such an increase of the ceiling and therefore does not give the EC the right to mobilise the necessary resources for the Recovery and Resilience Facility.

As already mentioned, the joint debt must be repaid by 2058. Where to get this money? The ways to get this funding can be different. Leaders of the Member States have agreed at the summit in July 2020 to work on new EU own resources that will be used to repay this debt. A carbon input adjustment mechanism, which will impose an additional tax on EU imports produced as a result of carbon-intensive emissions, and a digital tax, which will be levied on services provided in the digital environment, are mentioned. A banking transaction tax is also mentioned, and there is an invitation to come up with other proposals for own resources. It should be noted that agreement on EU-wide taxation is very difficult to achieve and the proposals are currently at an early stage of development. If no agreement is reached on new own resources, the default financial resources needed for debt repayment will come from EU Member States in proportion to their national GNI, which has so far been the main criteria for determining the size of Member States' contributions to the EU budget.

If contributions were made according to GNI, Latvia would have to pay 740 million euros in this case, which would have to be entered in the national budget on top of the current contributions to the EU budget. As can be seen, this amount is significantly less than the 1.82 billion euros Latvia can receive from the EU. The remaining 1.08 billion euros will be contributed by the richer EU Member States. To put it in perspective, Germany will contribute 480 million euros, France 160 million euros, the Netherlands 115 million euros and so on. This calculation is based on the 2019 GNI. Of course, the GNI will change in the coming years, but this does not change the overall picture significantly.

If contributions are made at EU level instead of at GNI level, the impact on EU Member States will be different from that of contributions at GNI level. A distinction should be made between the two options.

The first is to levy an additional tax or levy on EU taxpayers. If the tax or levy affects businesses operating in the EU, such as a banking transaction tax, it can be expected to have a direct impact on the price of banking services and will effectively be paid by EU businesses and citizens using banking services. This may not be the case in full, as banks could cover part of the additional costs by cutting profits.

The second is to tax third-country companies that sell goods or services in the EU, for example, by introducing a carbon import adjustment mechanism, or by forcing third-country IT companies to pay a profit tax on profits made from virtual operations in the EU. Presumably, in such cases, the debt will be paid by companies operating outside the EU. However, it can be expected that this will increase the prices of the products and services concerned and will again be paid for by businesses and citizens of EU countries.

So, whether the debt is repaid after the GNI or through separate taxes or levies, the burden will fall on EU businesses and citizens. The size and distribution of the burden will differ between countries.

So much for the mobilisation and repayment of the Recovery and Resilience Facility. Another aspect that deserves attention is the significant difference between these plans and the funding earmarked there for specific purposes when measured against the countries' own national budgets.

As already mentioned, Latvia can receive 1.82 billion euros from the EU as non-repayable funding (grant) for its Recovery and Resilience Facility Plan. The largest share, 72 billion euros, goes to Italy, while the smallest, 86 million euros, goes to Luxembourg. Germany receives 26 billion euros and France 39 billion euros. (These amounts are based on the EC's Winter 2020 macroeconomic forecasts and are subject to change). This is public funding that a country can use for investment and reform, in addition to its national budget. It is therefore important to compare this funding with the country's total public financial resources, i.e. the general government budget. This allows an assessment of how the Recovery and Resilience Facility contributes to public finances. On average, Latvia's Recovery and Resilience Facility Plan is 5% of its annual general government budget in any one year, compared to 3% for Italy and 0.6% for Germany. Bulgaria has the highest share of the national budget (9%) and Luxembourg the lowest (0.1%). The role of the Recovery and Resilience Facility Plan in the implementation of the projects they cover therefore varies considerably between Member States.

The rules stipulate that all Member States, regardless of the amount of funding from the Recovery and Resilience Facility, must allocate 37% to climate goals and 20% to the development of the digital sector. This means that Latvia must invest at least 1.9% of the available public financing resources for climate goals, while, for example, Germany 0.2%, Luxembourg 0.04%. In order to achieve the 2050 climate goals, these countries will, of course, invest a larger amount of funding in mitigating climate change, using their budget resources in addition to the Recovery and Resilience Facility. These data show that for rich countries, the proportion of funding earmarked for the climate and digital sectors in the Recovery and Resilience Facility Plan is less important in shaping the public investment mix than for less developed EU countries. Thus, for the economically weaker EU Member States, the Recovery and Resilience Facility Plan actually provides a very significant relative share of funding for climate change mitigation and digital sector development, relative to their budget levels. On one hand, it will ensure that these countries can make a significant contribution to the EU's overall climate goals. On the other hand, given that climate change mitigation measures require the purchase of high-tech equipment, mainly produced by the more economically developed EU Member States, such conditions ensure that part of the Recovery and Resilience Facility Plan's funding goes back into the economies of the developed Member States.